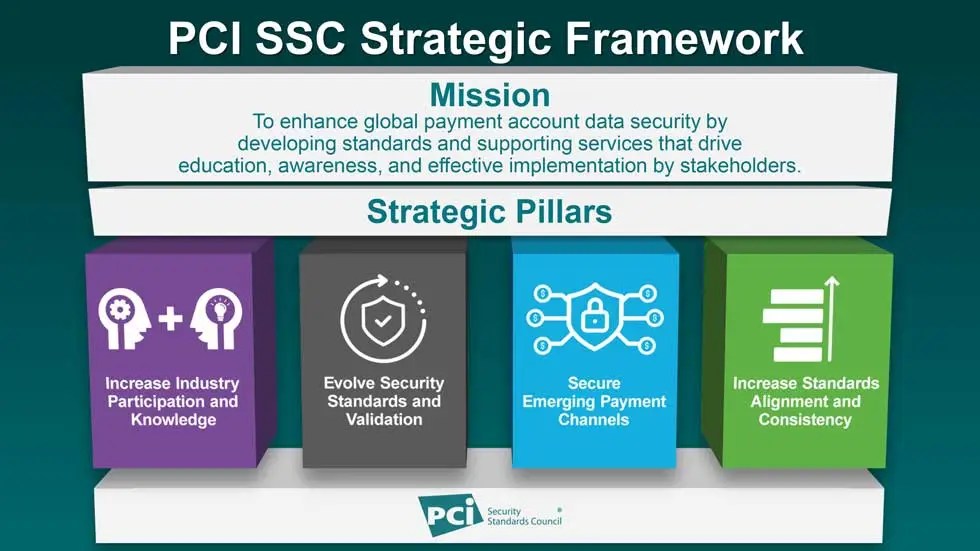

Match the correct efta and pci standards – Matching the European Free Trade Association (EFTA) and Payment Card Industry (PCI) standards is a critical aspect of ensuring the security of sensitive data. By aligning with both sets of requirements, organizations can establish robust and comprehensive protection measures that safeguard customer information, prevent data breaches, and maintain compliance.

The convergence of EFTA and PCI standards provides a holistic approach to data security, encompassing both the legal and technical aspects of data protection. This integrated framework ensures that organizations can effectively manage and mitigate risks associated with the handling of sensitive information.

Matching EFTA and PCI Standards

The European Free Trade Association (EFTA) and the Payment Card Industry Data Security Standard (PCI DSS) are two widely recognized standards for data security. While EFTA focuses on the protection of personal data in the European Economic Area (EEA), PCI DSS is specifically designed to safeguard payment card data.

Despite their different scopes, there are significant overlaps between EFTA and PCI DSS, and aligning with both standards can provide organizations with comprehensive data protection.

Methods for Matching EFTA and PCI Standards, Match the correct efta and pci standards

Matching EFTA and PCI DSS involves several key steps:

- Conduct a risk assessment:Identify the potential risks to personal data and payment card data within your organization.

- Map EFTA and PCI DSS requirements:Create a table comparing the requirements of both standards to identify areas of overlap and gaps.

- Develop a compliance plan:Artikel the specific measures you will take to meet the requirements of both standards.

- Implement and monitor controls:Put your compliance plan into action and monitor its effectiveness regularly.

Challenges in Matching EFTA and PCI Standards

Organizations may face several challenges in matching EFTA and PCI DSS, including:

- Different compliance timelines:EFTA has a phased implementation approach, while PCI DSS requires immediate compliance.

- Varying scope:EFTA applies to all personal data, while PCI DSS only applies to payment card data.

- Resource constraints:Implementing and maintaining compliance with both standards can require significant resources.

Despite these challenges, organizations that successfully overcome them can achieve significant benefits.

Benefits of Matching EFTA and PCI Standards

- Enhanced data security:Compliance with both standards ensures a comprehensive approach to data protection.

- Reduced risk of data breaches:Meeting the requirements of EFTA and PCI DSS helps organizations mitigate the risk of data breaches.

- Improved reputation:Demonstrating compliance with both standards can enhance an organization’s reputation for data security.

- Increased customer trust:Customers are more likely to trust organizations that prioritize data protection.

- Competitive advantage:Compliance with EFTA and PCI DSS can provide organizations with a competitive advantage in the marketplace.

FAQ Guide: Match The Correct Efta And Pci Standards

What are the key benefits of matching EFTA and PCI standards?

Matching EFTA and PCI standards provides numerous benefits, including enhanced data security, improved compliance, reduced risk of data breaches, and increased customer trust.

What are the common challenges in matching EFTA and PCI standards?

Some challenges in matching EFTA and PCI standards include resource constraints, lack of expertise, and the need to balance security with business needs.

How can organizations overcome the challenges in matching EFTA and PCI standards?

Organizations can overcome these challenges by conducting thorough risk assessments, prioritizing security initiatives, and seeking professional guidance from experts.